After finalizing 2022 payroll, after all corrections needed for 2022 W-2's are made, and BEFORE processing the first payroll in Vista, you will want to update all of your payroll rates and limits. Most new limits that will be required can be verified on the Internal Revenue Service website or with your CPA. State Unemployment limits and rates will usually be mailed to you or you can log into their website to access your company's rate.

Tax Table Update - PR Routine

Trimble Viewpoint will repeatedly update the PR Routine file throughout the year as withholding calculation tables are updated. If you are on the cloud, those tax updates are available for you to initialize. Refer to the email from Trimble notifying you of your company's update schedule to make sure of the date that they are available for you. If you have an on-premise server, your company will need to download the tax update.

BUT you are not finished there! You must go to

PR Routines, click on "File", and then Initialize. It will ask if you want to initialize PR Routine information, select "Yes", and the system will let you know when they have been initialized.

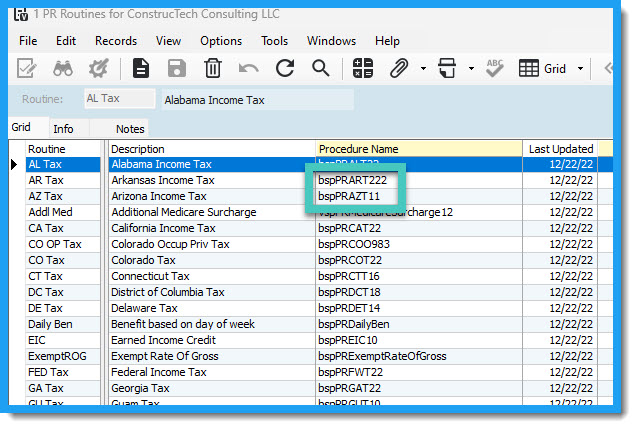

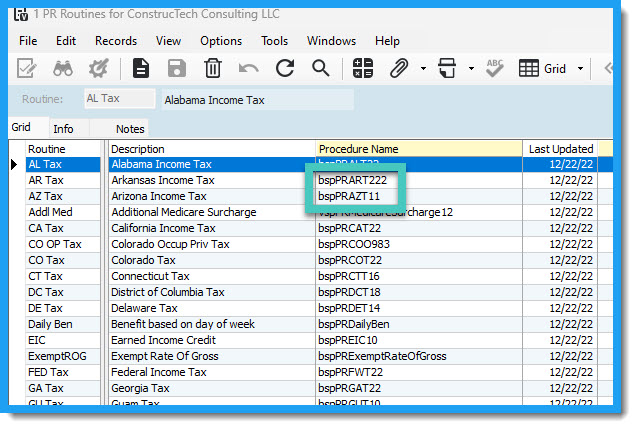

The "Last Updated" column will be updated with the current date but to make sure that the routine is updated, look at the Procedure Name column. The last two to three characters designates the year of the last update to the tax tables and if there is a third character that means that there were multiple versions of the tax file within that year. You can see in the example below that Arizona income tax tables have not been changed since 2011 and Arkansas income tax tables were changed twice in 2022.

Go to your deduction code AND your liability code for Social Security and make sure that the rates AND limits are the 2023 rates and limits.

FICA Medicare Rate - PR Deductions/Liabilities

Go to your deduction code AND your liability code for Medicare and make sure that the rates are the 2023 rates.

FICA Additional Medicare Limit and Rate - PR Deductions/Liabilities

Go to your deduction code for Additional Medicare and make sure that the rate is the 2023 rate. Then go to the PR Routine to make sure that the limit for the Routine "Addl Med" is the 2023 limit.

FUTA Limit and Rate - PR Deductions/Liabilities

Go to your liability code for FUTA and make sure that the rate AND limit is the 2023 rate and limit.

State Unemployment (SUTA/SUI) Limit and Rate - PR Deductions/Liabilities

Go to your liability code for each state's unemployment setup and make sure that the rates AND limits are the 2023 rates and limits.

401k Contributing Limits - PR Pre-Tax Deduction Groups

Go to your Pre-Tax Deduction Group Code for 401k, and any other similar groups that you may have, and make sure that the limit for regular and catch up contributions and the annual compensation limit are the 2023 limits.

Are there any other yearly limits that you may need to update in Vista? HSA? FSA? Pension Limits? Review your PR Deduction/ Liability codes to see if you may have other rates and limits that should be updated.

If you have any questions or concerns please reach out to us. Press the

Book A Call button and you can schedule some time with a consultant.